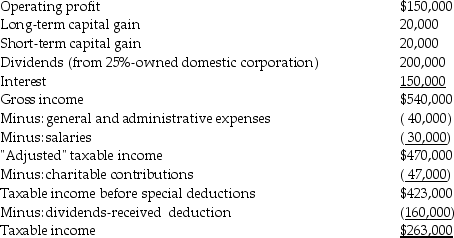

Mullins Corporation is classified as a PHC for the current year, reporting $263,000 of taxable income on its federal income tax return:

Actual charitable contributions made by Mullins Corporation were $75,000. What are the federal income tax due and the personal holding company (PHC) tax liability? Discuss the methods (if any) by which payment of the PHC tax can be avoided.

Actual charitable contributions made by Mullins Corporation were $75,000. What are the federal income tax due and the personal holding company (PHC) tax liability? Discuss the methods (if any) by which payment of the PHC tax can be avoided.

Definitions:

Traditional Costing

A costing methodology that allocates manufacturing overhead costs to products based on a predetermined rate, often volume-based such as labor hours or machine hours.

Direct Labor-Hours

An evaluation of the cumulative hours spent directly in the manufacturing of products.

Total Overhead Applied

The sum of all overhead costs that have been allocated to products or services based on a predetermined overhead rate.

Overhead Assigned

The process of allocating indirect costs to specific cost objects, such as products, services, or departments.

Q31: Identify which of the following statements is

Q32: Discuss the tax planning opportunities that are

Q37: Parent Corporation owns all of the stock

Q39: Identify which of the following statements is

Q39: Which of the following statements is incorrect?<br>A)

Q43: Identify which of the following statements is

Q68: Which of the following statements is true?<br>A)

Q74: Brown Corporation has assets with a $650,000

Q80: Identify which of the following statements is

Q96: Identify which of the following statements is