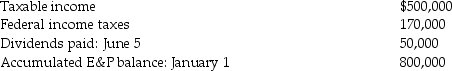

Lawrence Corporation reports the following results during the current year:

No dividends were paid in the throwback period. A long-term capital gain of $50,000 is included in taxable income. The statutory accumulated earnings tax exemption has been used up in prior years. An additional earnings accumulation of $60,000 for the current year can be justified as meeting the reasonable needs of the business. What is Lawrence Corporation's accumulated earnings tax liability?

No dividends were paid in the throwback period. A long-term capital gain of $50,000 is included in taxable income. The statutory accumulated earnings tax exemption has been used up in prior years. An additional earnings accumulation of $60,000 for the current year can be justified as meeting the reasonable needs of the business. What is Lawrence Corporation's accumulated earnings tax liability?

Definitions:

Confirmation Bias

The bias towards identifying, decoding, choosing, and memorizing details in a manner that validates one's preconceived ideas or suppositions.

Social Psychological Error

Involves misconceptions or biases in understanding or explaining the behavior of individuals in a social context.

Menstrual Cycle

The monthly hormonal cycle a female's body goes through to prepare for pregnancy.

Disease-Prone Personality

A theory suggesting that certain personality traits may make individuals more susceptible to developing specific diseases.

Q7: Identify which of the following statements is

Q12: Omega Corporation is formed in 2006. Its

Q18: Jeremey is a partner in the Jimimey

Q39: How does the use of a net

Q42: Identify which of the following statements is

Q62: Jacque, a single nonresident alien, is in

Q66: Jerry has a 10% interest in the

Q78: Mike and Jennifer form an equal partnership.

Q82: Checkers Corporation has a single class of

Q87: Acme Corporation acquires Fisher Corporation's assets in