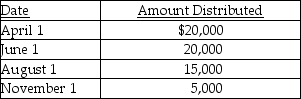

Exit Corporation has accumulated E&P of $24,000 at the beginning of the current tax year. Current E&P is $20,000. During the year, the corporation makes the following distributions to its sole shareholder who has a $22,000 basis for her stock.  The treatment of the $15,000 August 1 distribution would be

The treatment of the $15,000 August 1 distribution would be

Definitions:

Variable Manufacturing Overhead

Variable manufacturing overhead consists of production costs that fluctuate with the level of output, such as utilities and materials used in the production process.

Variable Overhead Rate Variance

The difference between the actual variable overhead rate incurred during a period and the standard variable overhead rate, multiplied by the actual activity level.

Variable Overhead Rate Variance

The difference between the actual variable overhead incurred and the standard cost allocated based on the actual levels of the allocation base.

Lubricants

Substances applied to reduce friction and wear between surfaces in mutual contact, often used in machinery and equipment to ensure smoother operation.

Q1: Identify which of the following statements is

Q31: Identify which of the following statements is

Q36: When computing the accumulated earnings tax, the

Q51: If a liquidating subsidiary corporation primarily has

Q59: Identify which of the following statements is

Q78: Identify which of the following statements is

Q78: Identify which of the following statements is

Q81: The accumulated earnings tax does not apply

Q83: Ajax and Brindel Corporations have filed consolidated

Q91: When is E&P measured for purposes of