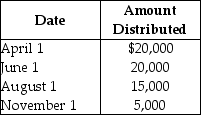

Payment Corporation has accumulated E&P of $19,000 and current E&P of $28,000. During the year, the corporation makes the following distributions to its sole shareholder:

The sole shareholder's basis in her stock is $45,000. What are the tax consequences of the June 1 distribution?

The sole shareholder's basis in her stock is $45,000. What are the tax consequences of the June 1 distribution?

Definitions:

Popular Demand

A large request from the public for a specific good, service, or action.

Formal Groups

Organized groups within a workplace or organization created to achieve specific objectives or tasks, characterized by structured communication and clear roles.

Social Capital

The networks of relationships among people who live and work in a particular society, enabling that society to function effectively.

Social Media

Digital platforms that enable users to create and share content or participate in social networking.

Q25: What are the tax consequences to Whitney

Q31: Corporations may deduct the adjusted basis of

Q33: The Supreme Court has held that literal

Q43: What is the penalty for a tax

Q46: Identify which of the following statements is

Q51: Identify which of the following statements is

Q74: Azar, who owns 100% of Hat Corporation,

Q92: What are the five steps in calculating

Q98: Identify which of the following statements is

Q101: Explain accountant-client privilege. What are the similarities