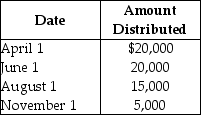

Payment Corporation has accumulated E&P of $19,000 and current E&P of $28,000. During the year, the corporation makes the following distributions to its sole shareholder:

The sole shareholder's basis in her stock is $45,000. What are the tax consequences of the June 1 distribution?

The sole shareholder's basis in her stock is $45,000. What are the tax consequences of the June 1 distribution?

Definitions:

Actual Total Variable Overhead Cost

The amount incurred in variable overhead expenses for actual production activities.

Standard Variable Overhead Rate

A predetermined rate used to allocate variable overhead costs to units of production, based on expected activity levels.

Practical Standards

Standards that allow for normal machine downtime and other work interruptions and that can be attained through reasonable, though highly efficient, efforts by the average worker.

Standard Quantity

This term refers to the amount of input (materials, labor, etc.) that should be used in the production of a unit of goods under normal conditions.

Q2: In a Type B reorganization, the target

Q23: On July 1, in connection with a

Q25: Explain the requirements a group of corporations

Q46: Identify which of the following statements is

Q66: Marty is a party to a tax-free

Q84: Poppy Corporation was formed three years ago.

Q101: Which of the following actions cannot be

Q108: Which of the following statements is not

Q110: Two days before the ex-dividend date, Drexel

Q120: Dexter Corporation reports the following results for