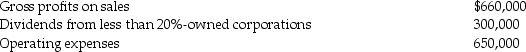

Carter Corporation reports the following results for the current year:

a) What is Carter Corporation's taxable income for the current year?

a) What is Carter Corporation's taxable income for the current year?

b) How would your answer to Part (a) change if Carter's operating expenses are instead $700,000?

c) How would your answer to Part (a) change if Carter's operating expenses are instead $760,000?

Definitions:

Southern Manifesto

A document written in 1956 that repudiated the Supreme Court decision in Brown v. Board of Education and supported the campaign against racial integration in public places.

Great Society

Term coined by President Lyndon B. Johnson in his 1965 State of the Union address, in which he proposed legislation to address problems of voting rights, poverty, diseases, education, immigration, and the environment.

Health Care

The organized provision of medical services to individuals or communities to maintain or improve health, including preventive, curative, and palliative interventions.

Urban Development

The planning and building of cities, including infrastructure and residential areas, to accommodate population growth and improve living conditions.

Q24: A calendar-year individual taxpayer files last year's

Q47: A U.S. corporation can claim a credit

Q53: Under the Subpart F rules, controlled foreign

Q61: Administrative expenses are not deductible on the

Q64: Jeff's tax liability for last year was

Q72: Define Sec. 306 stock.

Q75: What are the advantages and disadvantages of

Q89: Identify which of the following statements is

Q95: When computing corporate taxable income. what is

Q95: The term "trust income" when not preceded