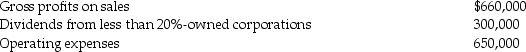

Carter Corporation reports the following results for the current year:

a) What is Carter Corporation's taxable income for the current year?

a) What is Carter Corporation's taxable income for the current year?

b) How would your answer to Part (a) change if Carter's operating expenses are instead $700,000?

c) How would your answer to Part (a) change if Carter's operating expenses are instead $760,000?

Definitions:

Labor

Human contributions, in terms of physical and mental efforts, towards the production of goods and services.

Machines

Equipment or devices designed to perform specific tasks or functions, often used in manufacturing and production processes.

Short-Run Total Cost

The total of all costs, both fixed and variable, incurred in producing goods or services in the short term.

Production Function

An equation or graph that shows the maximum output that can be produced with a given set of inputs.

Q18: Identify which of the following statements is

Q22: Barker Corporation, a personal service company, has

Q24: Identify which of the following statements is

Q33: Drury Corporation, which was organized three years

Q36: Glacier Corporation, a large retail sales company,

Q44: The general rule for tax attributes of

Q56: Identify which of the following statements is

Q56: An election to forgo an NOL carryback

Q57: In a nontaxable distribution of stock rights,

Q60: Explain the three functions of distributable net