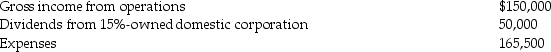

Dumont Corporation reports the following results in the current year:

What is Dumont's taxable income?

What is Dumont's taxable income?

Definitions:

Blood Relative

A person who shares an ancestor with another, indicating a family connection by birth rather than marriage.

Addictive Parent

A term drawing attention to the challenges and dynamics within families where one or more parents have substance abuse issues.

Methamphetamine

A powerful, highly addictive stimulant that affects the central nervous system.

Cocaine

A powerful stimulant drug derived from the leaves of the coca plant, notorious for its addictive properties and high potential for abuse.

Q3: Roby Corporation, a Tennessee corporation, decides to

Q9: In accounting for multinational corporations,<br>A) SFAS 109

Q61: Reba, a cash basis accountant, transfers all

Q61: Administrative expenses are not deductible on the

Q67: Jerry transfers two assets to a corporation

Q69: Chambers Corporation is a calendar year taxpayer

Q80: Four years ago, Roper transferred to his

Q89: Identify which of the following statements is

Q89: Identify which of the following statements is

Q91: A simple trust has a distributable net