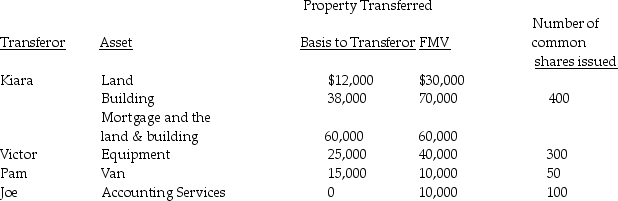

On May 1 of the current year, Kiara, Victor, Pam, and Joe form Newco Corporation with the following investments:

Kiara purchased the land and building several years ago for $12,000 and $50,000, respectively. Kiara has claimed straight-line depreciation on the building. Victor also received a Newco Corporation note for $10,000 due in three years. The note bears interest at a rate acceptable to the IRS. Victor purchased the equipment three years ago for $50,000. Pam also receives $5,000 cash. Pam purchased the van two years ago for $20,000.

Kiara purchased the land and building several years ago for $12,000 and $50,000, respectively. Kiara has claimed straight-line depreciation on the building. Victor also received a Newco Corporation note for $10,000 due in three years. The note bears interest at a rate acceptable to the IRS. Victor purchased the equipment three years ago for $50,000. Pam also receives $5,000 cash. Pam purchased the van two years ago for $20,000.

a) Does the transaction satisfy the requirements of Sec. 351?

b) What are the amounts and character of the reorganized gains or losses to Kiara, Victor, Pam, Joe, and Newco Corporation?

c) What is each shareholder's basis for his or her Newco stock? When does the holding period for the stock begin?

d) What is Newco Corporation's basis for its property and services? When does its holding period begin for each property?

Definitions:

Saving Rate

The portion of disposable income that is not spent on consumption but saved or invested.

Rate Of Return

The gain or loss on an investment over a specified period, expressed as a percentage of the investment's cost.

Studies

Systematic investigations or research aimed at acquiring knowledge and understanding through observation, experimentation, and analysis.

Policymakers

Individuals or groups responsible for making decisions on public policy in government, organizations, or institutions, often influencing laws, regulations, and strategies.

Q3: Identify which of the following statements is

Q8: The GSTT's (generation-skipping transfer tax) purpose is<br>A)

Q12: Excess foreign taxes in one basket cannot

Q17: How does the use of an NOL

Q28: Under what circumstances does a liquidating corporation

Q30: The 90-day letter (Statutory Notice of Deficiency)

Q46: Identify which of the following statements is

Q62: Joan transfers land (a capital asset) having

Q75: Karen, a U.S. citizen, earns $40,000 of

Q84: The purchase of a $15,000 engagement ring