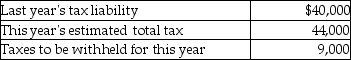

Your client wants to avoid any penalty for underpayment of estimated taxes by making timely deposits. Determine the amount of the minimum quarterly estimated tax payments required to avoid the penalty. Assume your client's adjusted gross income last year was $140,000.

Definitions:

Start-Up Capital

The initial investment required to start a new business or launch a new product.

Financial Return

The profit or loss generated on an investment over a specific period, often expressed as a percentage of the initial investment cost.

Teambuilding

The process of creating a cohesive and effective team through activities and exercises that enhance communication, trust, and collaboration among members.

Managing Director

A senior executive responsible for the day-to-day management of a company, often equivalent to a Chief Executive Officer (CEO) in some countries.

Q7: What is the branch profits tax? Explain

Q23: Beneficiaries of a trust may receive<br>A) an

Q30: The personal exemption available to a trust

Q40: Gofer Corporation, an S corporation, is owned

Q45: During the year, Soup Corporation contributes some

Q47: Identify which of the following statements is

Q70: The estate tax is a wealth transfer

Q73: Green Corporation is incorporated on March 1

Q77: Which of the following items is a

Q82: In 2014, the unified credit enables an