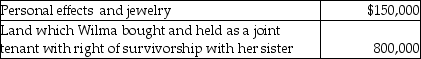

Following are the fair market values of Wilma's assets at her date of death:  The executor of Wilma's estate did not elect the alternate valuation date. The amount includible in Wilma's gross estate is

The executor of Wilma's estate did not elect the alternate valuation date. The amount includible in Wilma's gross estate is

Definitions:

Mergers

The combination of two or more entities into one, through either the acquisition of one by another or the consolidation of the entities into a new entity.

Approval Certificate

A document issued by an authoritative body that verifies certain conditions have been met or standards have been achieved.

Appraisal Rights

The right of a shareholder to demand an independent evaluation of the value of shares before a major structural change in a corporation.

Share Value

Refers to the identified worth of a single share of a company's stock, determined by market activities and influencing investor decisions.

Q2: The limited liability company (LLC) has become

Q23: Steve gave stock with an adjusted basis

Q27: Identify which of the following statements is

Q30: The estate tax return is due, ignoring

Q32: Explain why living trusts are popular tax-planning

Q42: The TK Partnership has two assets: $20,000

Q48: Identify which of the following statements is

Q73: Which of the following corporate tax levies

Q75: Explain the legislative reenactment doctrine.

Q76: Ward and June decide to divorce after