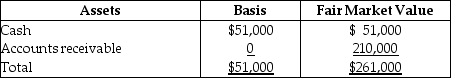

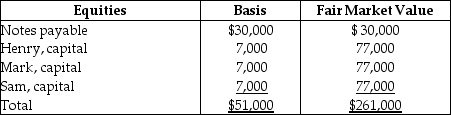

The HMS Partnership, a cash method of accounting entity, has the following balance sheet at December 31 of last year:

Sam, who has a one-third interest in profits, losses, and liabilities, sells his partnership interest to Beverly, for $77,000 cash on January 1 of this year. Sam's basis in his partnership interest (which, of course, includes a share of partnership liabilities) at the time of the sale was $17,000. In addition, Beverly assumes Sam's share of the partnership liabilities. What is the amount and character of the gain that Sam will recognize from this sale?

Sam, who has a one-third interest in profits, losses, and liabilities, sells his partnership interest to Beverly, for $77,000 cash on January 1 of this year. Sam's basis in his partnership interest (which, of course, includes a share of partnership liabilities) at the time of the sale was $17,000. In addition, Beverly assumes Sam's share of the partnership liabilities. What is the amount and character of the gain that Sam will recognize from this sale?

Definitions:

Cash Flows

Refers to the streams of incoming and outgoing cash transactions resulting from a company's operational, investing, and financing activities.

Future Value

The value of an investment at a specific future date, considering compound interest or returns.

Interest Rate

The cost of borrowing money or the compensation for the service and risk of lending money, expressed as a percentage of the principal loan amount.

Cash Flows

The movement of funds into and out of a business, project, or financial product, reflecting operational, investment, and financing activities.

Q26: Although he founded functionalism and its emphasis

Q33: A(n) _is a number of people who

Q37: In which courts may litigation dealing with

Q42: A(n) _ status is a social position

Q45: Worshipers at religious revival services and revelers

Q49: Which of the following statements regarding proposed

Q56: Vincent makes the following property transfers in

Q59: A(n)_ is violent crowd behavior that is

Q78: Facebook friends and people following someone on

Q87: Calvin transfers land to a trust. Calvin