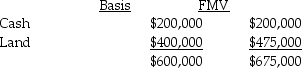

Sean, Penelope, and Juan formed the SPJ partnership by each contributing assets with a basis and fair market value of $200,000. In the following year, Penelope sold her one-third interest to Pedro for $225,000. At the time of the sale, the SPJ partnership had the following balance sheet:

Shortly after Pedro became a partner, SPJ sold the land for $475,000. What are the tax consequences of the sale to Pedro and the partnership (1) assuming there is no Section 754 election in place, and (2) assuming the partnership has a valid Section 754 election?

Shortly after Pedro became a partner, SPJ sold the land for $475,000. What are the tax consequences of the sale to Pedro and the partnership (1) assuming there is no Section 754 election in place, and (2) assuming the partnership has a valid Section 754 election?

Definitions:

Production Facility

A location equipped with machinery and equipment for manufacturing goods, often structured to optimize workflow and efficiency.

Variable Cost

Costs that vary in direct proportion to changes in a business's production volume or level of activity.

Unit Product Costs

The total cost associated with producing a single unit of product, including direct materials, direct labor, and overhead.

Intermediate Product

A product that requires further processing before it becomes a finished good.

Q51: The acquiescence policy of the IRS extends

Q54: Mirabelle contributed land with a $5,000 basis

Q61: _movements seek to prevent change or to

Q63: Corporations and partnerships can be S corporation

Q73: A jury trial is permitted in the<br>A)

Q81: Identify which of the following statements is

Q95: Tony sells his one-fourth interest in the

Q96: Once a rumor begins to circulate, it

Q101: King Corporation, a cash method taxpayer that

Q126: _refers to the process by which an