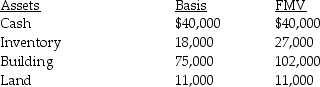

David sells his one-third partnership interest to Diana for $60,000 when his basis in the partnership interest is $48,000. On the date of sale, the partnership has no liabilities and the following assets:

The building is depreciated on a straight-line basis. What tax issues should David and Diana consider with respect to the sale transaction?

The building is depreciated on a straight-line basis. What tax issues should David and Diana consider with respect to the sale transaction?

Definitions:

Critical Thinking

The process of objectively analyzing and evaluating an issue in order to form a judgment.

Evaluating

The process of assessing or examining something with the possibility or intention of instituting change if necessary.

Listening Process

A systematic approach to receiving and interpreting spoken messages or information.

Nonverbal Clues

Subtle signals or cues expressed through body language, facial expressions, and other physical behaviors that communicate feelings or intentions.

Q28: A corporation must make an S election

Q36: A partnership terminates for federal income tax

Q45: Identify which of the following statements is

Q61: Administrative expenses are not deductible on the

Q62: Which of the following best describes the

Q82: Which of the following statements is correct?<br>A)

Q83: Identify which of the following statements is

Q90: According to both Durkheim and Tӧnnies, social

Q92: For tax purposes, a partner who receives

Q101: On September 1, George transfers his entire