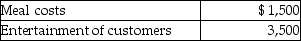

Steven is a representative for a textbook publishing company.Steven attends a convention which will also be attended by many potential customers.During the week of the convention,Steven incurs the following costs in entertaining potential customers.  Having recently been to a company seminar on tax laws,Steven makes sure that business is discussed at the various dinners,and that the entertainment is on the same day as the meetings with customers.Steven is reimbursed $2,000 by his employer under an accountable plan.Steven's AGI for the year is $50,000,and while he itemizes deductions,he has no other miscellaneous itemized deductions.What is the amount and character of Steven's deduction after any limitations?

Having recently been to a company seminar on tax laws,Steven makes sure that business is discussed at the various dinners,and that the entertainment is on the same day as the meetings with customers.Steven is reimbursed $2,000 by his employer under an accountable plan.Steven's AGI for the year is $50,000,and while he itemizes deductions,he has no other miscellaneous itemized deductions.What is the amount and character of Steven's deduction after any limitations?

Definitions:

School Funding

The financial resources provided for public schools, typically derived from taxes and allocated by governmental entities to support education.

Constituents

Members or components that form a part of a larger group, or individuals who are represented by elected officials.

Government Failure

Inefficiencies in resource allocation caused by problems in the operation of the public sector (government). Specific examples include the principal-agent problem, the special-interest effect, the collective-action problem, rent seeking, and political corruption.

Special-Interest Effect

The phenomenon where a small group gains substantially through an action or policy while the larger population bears the cost, often seen in political lobbying.

Q11: An example of a community nutrition program

Q17: The least expensive forms of breakfast cereal

Q18: The effect of the hormone prolactin is

Q27: Normal serum albumin level is:<br>A) 2.0 to

Q38: Malnutrition in older adults is linked to:<br>A)

Q40: During early adulthood, men require more energy

Q70: When applying the limitations of the passive

Q70: A taxpayer has made substantial donations of

Q96: Tasneem,a single taxpayer has paid the following

Q112: Hui pays self-employment tax on her sole