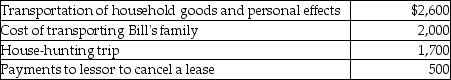

Bill obtained a new job in Boston.He incurred the following moving expenses:  Assuming Bill is entitled to deduct moving expenses,what is the amount of the deduction?

Assuming Bill is entitled to deduct moving expenses,what is the amount of the deduction?

Definitions:

Higher-Quality Materials

Substances or components that are superior in terms of durability, texture, and overall performance in the manufacturing of products.

Trading Up

A business strategy that involves convincing customers to purchase more expensive items, upgrades, or add-ons in an effort to increase profitability.

Package Content

The items or materials contained inside a package.

Downsizing

The process of reducing a company's workforce and/or scaling back its operations to lower expenses and streamline its organization.

Q3: A hospital diet that would be considered

Q5: Foods and drugs used to enhance athletic

Q19: Capital expenditures for medical care which permanently

Q33: The medication used in the treatment of

Q43: If a woman has a body mass

Q53: A qualified pension plan requires that employer-provided

Q79: An employer adopts a per diem policy

Q96: Brienne sells land to her brother,Abe,at a

Q96: Tasneem,a single taxpayer has paid the following

Q109: Which of the following is deductible as