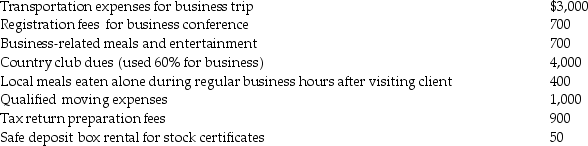

Rita,a single employee with AGI of $100,000 before consideration of the items below,incurred the following expenses during the year,all of which were unreimbursed unless otherwise indicated:  In addition,Rita paid $300 for dues to her professional business association.The company reimbursed her after she submitted the appropriate documentation for the dues.What is Rita's net miscellaneous itemized deduction for the year after application of all relevant limitations?

In addition,Rita paid $300 for dues to her professional business association.The company reimbursed her after she submitted the appropriate documentation for the dues.What is Rita's net miscellaneous itemized deduction for the year after application of all relevant limitations?

Definitions:

Emotional Intelligence

The ability to recognize, understand, and manage one's own emotions and those of others in a productive and healthy manner.

G Factor

A term used in psychology, referring to the general intelligence factor believed to underlie all intelligent activity.

Analytical Intelligence

The ability to analyze, evaluate, judge, compare, and contrast information.

Creative Intelligence

The ability to generate novel and useful ideas or solutions to problems.

Q19: A taxpayer purchased an asset for $50,000

Q21: A client who has been authorized to

Q30: For a healthy person, the percentage of

Q35: It has been generally accepted that the

Q52: Which of the following is not required

Q68: During the current year,Charlene borrows $10,000 to

Q71: Vanessa owns a houseboat on Lake Las

Q75: In the current year,Julia earns $9,000 in

Q75: Amy,a single individual and sole shareholder of

Q101: Jana reports the following income and loss: