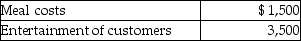

Steven is a representative for a textbook publishing company.Steven attends a convention which will also be attended by many potential customers.During the week of the convention,Steven incurs the following costs in entertaining potential customers.  Having recently been to a company seminar on tax laws,Steven makes sure that business is discussed at the various dinners,and that the entertainment is on the same day as the meetings with customers.Steven is reimbursed $2,000 by his employer under an accountable plan.Steven's AGI for the year is $50,000,and while he itemizes deductions,he has no other miscellaneous itemized deductions.What is the amount and character of Steven's deduction after any limitations?

Having recently been to a company seminar on tax laws,Steven makes sure that business is discussed at the various dinners,and that the entertainment is on the same day as the meetings with customers.Steven is reimbursed $2,000 by his employer under an accountable plan.Steven's AGI for the year is $50,000,and while he itemizes deductions,he has no other miscellaneous itemized deductions.What is the amount and character of Steven's deduction after any limitations?

Definitions:

Black Churches

Churches within the African-American community that have historically served as centers for spiritual guidance, social support, and civil rights activism.

Civil Rights Movement

A social and political movement primarily during the 1950s and 1960s in the United States, aimed at ending racial discrimination and securing legal rights for African Americans.

Breeding Ground

An environment that facilitates or fosters the growth or development of certain traits or entities.

Social Integration

The process by which individuals or groups are incorporated into the social structure, becoming integrated into the values, norms, and practices of society.

Q19: Ground meat should not be stored in

Q19: Peer modeling begins to influence food choices

Q24: The three components that identify obesity as

Q39: The nutritional status of hospitalized clients is

Q61: Jordan,an employee,drove his auto 20,000 miles this

Q75: Kelsey enjoys making cupcakes as a hobby

Q86: Deductible moving expenses include the cost of

Q95: Sarah had a $30,000 loss on Section

Q101: Alan,who is a security officer,is shot while

Q110: Corporations issuing incentive stock options receive a