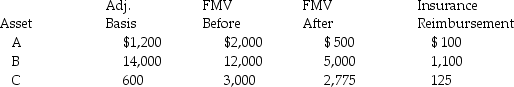

Determine the net deductible casualty loss on the Schedule A for Alan Michael when his adjusted gross income was $40,000 in 2015 and the following occurred:  A and B were destroyed in the same casualty in March.C was destroyed in a separate casualty in July.

A and B were destroyed in the same casualty in March.C was destroyed in a separate casualty in July.

All casualty losses were nonbusiness personal use property losses and none occurred in a federally declared disaster area.

What is the amount of the net deductible casualty loss?

Definitions:

Formalities

Specific procedures or requirements mandated by law or custom that must be observed to validate a legal document, agreement, or transaction.

Fraud

The wrongful or criminal deception intended to result in financial or personal gain.

Per Stirpes

A method of distributing an intestate’s estate so that each heir in a certain class (such as grandchildren) takes the share to which her or his deceased ancestor (such as a mother or father) would have been entitled.

Distribute

To allocate or spread out resources or goods across different recipients or areas.

Q6: Most weight gained during pregnancy consists of:<br>A)

Q7: Bad debt losses from nonbusiness debts are

Q11: Candice owns a mutual fund that reinvests

Q12: Erin,Sarah,and Timmy are equal partners in EST

Q13: Inadequate intake of iodine during pregnancy may

Q15: Pregnant women need adequate intakes of the

Q26: During the 3-day period before competing in

Q96: Stock purchased on December 15,2014,which becomes worthless

Q97: Raul and Jenna are married and are

Q108: Joel has four transactions involving the sale