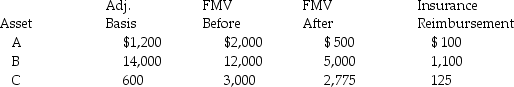

Determine the net deductible casualty loss on the Schedule A for Alan Michael when his adjusted gross income was $40,000 in 2015 and the following occurred:  A and B were destroyed in the same casualty in March.C was destroyed in a separate casualty in July.

A and B were destroyed in the same casualty in March.C was destroyed in a separate casualty in July.

All casualty losses were nonbusiness personal use property losses and none occurred in a federally declared disaster area.

What is the amount of the net deductible casualty loss?

Definitions:

Variable Costs

Costs that vary directly with the level of production or sales volume, such as raw materials and direct labor.

Average Operating Assets

The average value of the assets used in the normal course of business to generate operating income, often calculated over a period to assess performance.

Controllable Fixed Costs

Costs that management has the power to influence or change in the short term.

Budgetary Control

The process of monitoring financial budgets by comparing actual performance with the budgeted amounts to manage financial resources effectively.

Q10: If a nontaxable stock dividend is received

Q16: Legal fees for drafting a will are

Q30: Constance,who is single,is in an automobile accident

Q33: Tessa is a self-employed CPA whose 2015

Q69: What must an individual taxpayer prove to

Q91: Generally,gains resulting from the sale of collectibles

Q98: Taxpayers who own mutual funds recognize their

Q101: For purposes of calculating depreciation,property converted from

Q108: Which of the following statements is incorrect

Q123: Discuss when expenses are deductible under the