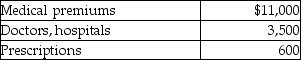

Caleb's medical expenses before reimbursement for the year include the following:  Caleb's AGI for the year is $50,000.He is single and age 58.Caleb also receives a reimbursement for medical expenses of $1,000.Caleb's deductible medical expenses that will be added to the other itemized deduction will be

Caleb's AGI for the year is $50,000.He is single and age 58.Caleb also receives a reimbursement for medical expenses of $1,000.Caleb's deductible medical expenses that will be added to the other itemized deduction will be

Definitions:

Linear Regression

A statistical method for modeling the relationship between a dependent variable and one or more independent variables by fitting a linear equation to observed data.

Interpolation

To predict corresponding variables within the domain.

Extrapolation

To predict corresponding variables outside of the domain.

Regression Line

In statistics, a line that best fits a set of data points, reflecting the relationship between an independent variable and a dependent variable.

Q1: Older adults may have limited access to

Q6: Linda was injured in an automobile accident

Q21: A client who has been authorized to

Q23: Jeff owned one passive activity.Jeff sold the

Q28: Investment interest expense which is disallowed because

Q44: What is required for an individual to

Q45: A food choice equivalent to one serving

Q92: Mae Li is beneficiary of a $70,000

Q99: Juan has a casualty loss of $32,500

Q137: Amanda,whose tax rate is 33%,has NSTCL of