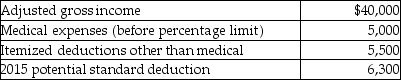

A review of the 2015 tax file of Gregory,a single taxpayer who is age 40,provides the following information regarding Gregory's 2015 tax status:  In 2016,Gregory receives a reimbursement for last year's medical expenses of $1,200.As a result,Gregory must

In 2016,Gregory receives a reimbursement for last year's medical expenses of $1,200.As a result,Gregory must

Definitions:

Corporate Debt

Financial obligations owed by a corporation, typically in the form of bonds, loans, or other types of securities.

Charitable Contributions

Donations made to qualifying organizations which may be deductible from the donor's taxable income, subject to IRS rules and limitations.

Tax Liability

The total amount of taxes owed to federal, state, or local tax authorities for a given period, before any payments or credits are applied.

Taxable Income

The amount of an individual's or corporation's income used to determine how much tax is owed, after all deductions and exemptions are accounted for.

Q3: A cost-conscious shopper can often find nutritious

Q7: A taxpayer incurs a net operating loss

Q22: In 2015,Carlos filed his 2014 state income

Q34: Bret carries a $200,000 insurance policy on

Q49: Ankle edema during pregnancy is:<br>A) a normal

Q73: Carl purchased a machine for use in

Q78: Tyler (age 50)and Connie (age 48)are a

Q88: Melanie,a U.S.citizen living in Paris,France,for the last

Q105: Self-employed individuals receive a for AGI deduction

Q115: Business investigation expenses incurred by a taxpayer