MrAnd MrsThibodeaux,who Are Filing a Joint Return,have Adjusted Gross Income of of $75,000.During

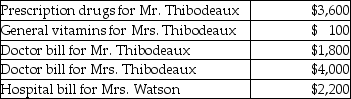

Mr.and Mrs.Thibodeaux,who are filing a joint return,have adjusted gross income of $75,000.During the tax year,they paid the following medical expenses for themselves and for Mrs.Thibodeaux's mother,Mrs.Watson (age 63) .Mrs.Watson provided over one-half of her own support.  Mr.and Mrs.Thibodeaux received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

Mr.and Mrs.Thibodeaux received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

Definitions:

Spiritual Beliefs

Personal or communal beliefs and practices related to the sense of connection with the transcendent, often experienced as a guiding force in life.

Peace and Acceptance

A state of mind characterized by tranquility and a positive reception of one's current circumstances.

Spiritual Care

The support and guidance provided to individuals in matters related to their beliefs, values, and connection to the divine or something greater than themselves, especially during challenging times.

Altruism

The selfless concern for the well-being of others, often leading to acts of kindness without expectation of reciprocation.

Q7: Factors that may increase food costs include:<br>A)

Q18: Craving and intake of unusual nonfood substances

Q26: Gross income may be realized when a

Q32: An infant will usually double his or

Q43: A major focus of the 2010 Dietary

Q74: The following individuals maintained offices in their

Q87: Expenditures for a weight reduction program are

Q95: Abigail's hobby is sculpting.During the current year,Abigail

Q111: Mara owns an activity with suspended passive

Q137: Which statement is correct regarding SIMPLE retirement