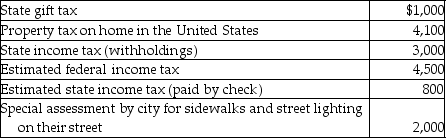

During the year Jason and Kristi,cash basis taxpayers,paid the following taxes:  What amount can Kristi and Jason claim as an itemized deduction for taxes on their federal income tax return in the current year?

What amount can Kristi and Jason claim as an itemized deduction for taxes on their federal income tax return in the current year?

Definitions:

Freelancer

Someone who is paid for specific projects, items to create, and products on a project basis.

Social Media Strategy

A detailed plan outlining how a business or individual will use social media platforms to achieve communication objectives and target goals.

Flexibility

The ability to adapt quickly and efficiently to changing conditions or situations without significant loss of function or quality.

Independence

Refers to the state or quality of being free from external control or support.

Q14: Sari is single and has taxable income

Q29: Tess has started a new part-time business.She

Q34: The destruction of a capital asset by

Q38: A physical science that contributes to understanding

Q43: An important principle guiding the infant feeding

Q54: Jessica owned 200 shares of OK Corporation

Q55: Interest incurred during the development and manufacture

Q61: All of the following fringe benefits paid

Q71: Ron and Eve are a married couple

Q102: During the current year,Tony purchased new car