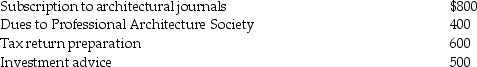

Wang,a licensed architect employed by Skye Architects,incurred the following unreimbursed expenses this year:  Wang's AGI is $75,000.What is his net deduction for miscellaneous itemized deductions?

Wang's AGI is $75,000.What is his net deduction for miscellaneous itemized deductions?

Definitions:

Income Tax Expense

The amount of money a company owes in taxes based on its taxable income.

Income from Operations

The earnings generated from a company's regular business activities before taxes and interest, indicating the efficiency of core operational management.

Dividend Revenue

Income received from holding shares of stock in another company that pays dividends to its shareholders.

Income Before Taxes

A company's earnings before tax is deducted, an indicator of financial performance excluding tax expenses.

Q2: During the current year,Don's aunt Natalie gave

Q33: Tessa is a self-employed CPA whose 2015

Q40: Some of the main factors that influence

Q65: Bridget owns 200 shares of common stock

Q71: Dennis purchased a machine for use in

Q77: The amount of loss realized on the

Q82: How is a claim for refund of

Q100: Distributions from corporations to the shareholders in

Q117: If a capital asset held for one

Q123: Discuss when expenses are deductible under the