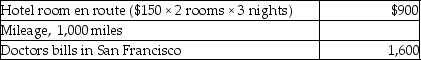

In 2015 Sela traveled from her home in Flagstaff to San Francisco to seek medical care.Because she was unable to travel alone,her mother accompanied her.Total expenses included:  The total medical expenses deductible before the 10% limitation are

The total medical expenses deductible before the 10% limitation are

Definitions:

Cell Membrane

The semipermeable membrane surrounding the cytoplasm of a cell, regulating the passage of substances in and out.

Proton

A subatomic particle found in the nucleus of an atom, carrying a positive electric charge.

Chemical Unit

A measurement or quantity of a chemical substance that is considered a standard or basic amount for scientific experiments and calculations.

Tissue

Groups of cells within an organism that have similar structure and function.

Q8: For charitable contribution purposes,capital gain property includes

Q22: A taxpayer moves for employment in November

Q36: Jeremy,an American citizen,earned $200,000 during 2015 while

Q48: Kickbacks and bribes paid to federal officials

Q85: On July 25,2014,Karen gives stock with a

Q88: A taxpayer may deduct suspended losses of

Q96: All of the following may deduct education

Q103: Tanya is considering whether to rollover her

Q108: Van pays the following medical expenses this

Q112: Hui pays self-employment tax on her sole