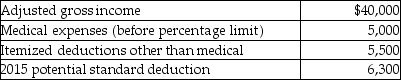

A review of the 2015 tax file of Gregory,a single taxpayer who is age 40,provides the following information regarding Gregory's 2015 tax status:  In 2016,Gregory receives a reimbursement for last year's medical expenses of $1,200.As a result,Gregory must

In 2016,Gregory receives a reimbursement for last year's medical expenses of $1,200.As a result,Gregory must

Definitions:

Rationalizing

The process of attempting to explain or justify behavior or an attitude with logical reasons, even if these are not appropriate.

Underutilizing

Not making the most effective or efficient use of a resource, person, or capability.

Overloading

A situation where an individual or system is given more work or information than can be handled comfortably or efficiently.

Skill Set

A collection of skills and abilities that an individual possesses, which can be applied in various jobs, tasks, or projects.

Q2: Toddlers whose diet consists primarily of milk

Q3: Leo spent $6,600 to construct an entrance

Q10: The mineral that helps control enzyme actions

Q17: In order to be recognized and deducted

Q18: Craving and intake of unusual nonfood substances

Q19: Ground meat should not be stored in

Q44: With regard to taxable gifts after 1976,no

Q53: A qualified pension plan requires that employer-provided

Q79: A business provides $45,000 of group-term life

Q80: A taxpayer may deduct a loss resulting