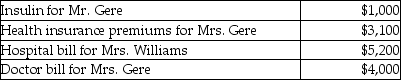

Mr.and Mrs.Gere,who are filing a joint return,have adjusted gross income of $50,000.During the tax year,they paid the following medical expenses for themselves and for Mrs.Gere's mother,Mrs.Williams.The Gere's could claim Mrs.Williams as their dependent,but she has too much gross income.  Mr.and Mrs.Gere received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

Mr.and Mrs.Gere received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

Definitions:

Tone

The quality or character of sound, or in literature, the author's attitude towards the subject or audience.

Blinking

The rapid closing and opening of the eyelid, a reflex that helps to protect the eye from irritants and distribute tear fluid.

Conditioned Stimulus

An initially neutral signal that, upon being linked with an unconditioned stimulus, ultimately incites a learned response.

Clicking

In the context of computer usage, it refers to pressing and releasing a button on a mouse or other input device to select or interact with elements on a screen.

Q1: Older adults may have limited access to

Q2: On December 1,2015,Delilah borrows $2,000 from her

Q28: An important last step in conducting a

Q30: Samuel,a calendar year taxpayer,owns 100 shares of

Q55: Jamie sells investment real estate for $80,000,resulting

Q78: Tyler (age 50)and Connie (age 48)are a

Q101: If an activity produces a profit for

Q115: Mitzi's medical expenses include the following: <img

Q131: On August 1 of the current year,Terry

Q136: A taxpayer goes out of town to