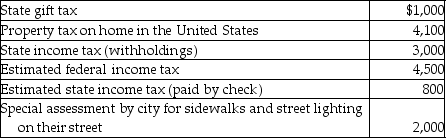

During the year Jason and Kristi,cash basis taxpayers,paid the following taxes:  What amount can Kristi and Jason claim as an itemized deduction for taxes on their federal income tax return in the current year?

What amount can Kristi and Jason claim as an itemized deduction for taxes on their federal income tax return in the current year?

Definitions:

Received

Typically refers to the acknowledgement of having gotten something, such as goods or payments, within a business context.

Recognized

In accounting, recognized refers to the formal acknowledgment in financial statements that a transaction or event has impacted the entity's financial position or performance.

Book Value

The net value of a company's assets as found on its balance sheet, and is calculated by subtracting liabilities from the value of assets.

Depreciable Asset

An asset that diminishes in value over time due to use, wear and tear, or obsolescence, which can be deducted over its useful life.

Q30: An employee has unreimbursed travel and business

Q39: The best way to relieve constipation during

Q43: Rita,who has marginal tax rate of 39.6%,is

Q52: Section 1221 of the Code includes a

Q64: If Houston Printing Co.purchases a new printing

Q88: Qualified residence interest consists of both acquisition

Q93: Deductions for adjusted gross income include all

Q101: Kelly was sent by her employer to

Q118: AAA Corporation distributes an automobile to Alexandria,a

Q140: Ross works for Houston Corporation,which has a