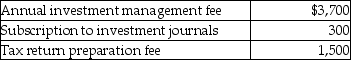

Nina includes the following expenses in her miscellaneous itemized deductions before application of the 2% of AGI floor:  Nina's AGI is $100,000.How much of the above-noted expenses will reduce her net investment income?

Nina's AGI is $100,000.How much of the above-noted expenses will reduce her net investment income?

Definitions:

Assessment

The systematic evaluation and measurement of psychological, biological, and social factors in an individual or group.

Testing

The process of administering assessments to evaluate skills, knowledge, abilities, or performance in various areas.

Records And Documentation

Written materials and other evidence, including electronic and paper formats, that provide a record of activities, transactions, and decisions.

Psychopathology

The examination of psychological disorders, encompassing their signs, origins, and therapeutic methods.

Q8: Raoul sells household items on an Internet

Q9: Under the economist's definition,unrealized gains,as well as

Q11: All payments made by an employer to

Q16: Armanti received a football championship ring in

Q18: Craving and intake of unusual nonfood substances

Q61: All of the following fringe benefits paid

Q65: An individual is considered terminally ill for

Q77: According to the tax formula,individuals can deduct

Q82: Nikki is a single taxpayer who owns

Q139: Which of the following situations will disqualify