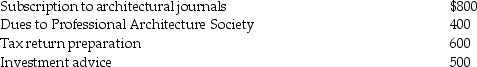

Wang,a licensed architect employed by Skye Architects,incurred the following unreimbursed expenses this year:  Wang's AGI is $75,000.What is his net deduction for miscellaneous itemized deductions?

Wang's AGI is $75,000.What is his net deduction for miscellaneous itemized deductions?

Definitions:

Memorandum

A written document that communicates information, policies, or decisions within an organization or between entities.

Lift The Corporate Veil

A legal action to treat the rights or liabilities of a corporation as the rights or liabilities of its shareholders or directors.

Pre-Emptive Rights

Rights granted to existing shareholders to purchase additional shares before the company offers them to the public, to maintain their percentage of ownership.

Insolvent

A financial state where an individual or entity cannot meet their debt obligations as they come due or has liabilities exceeding assets.

Q16: Qualified dividends received by individuals are taxed

Q21: Taxpayers may use the standard mileage rate

Q36: The Special Supplemental Program for Women, Infants,

Q55: Daniel purchased qualified small business corporation stock

Q82: How is a claim for refund of

Q92: The requirements for a payment to be

Q92: In a basket purchase,the total cost is

Q110: Expenses incurred in a trade or business

Q111: When are points paid on a loan

Q129: Distributions in excess of a corporation's current