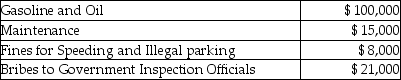

Jimmy owns a trucking business.During the current year he incurred the following:  What is the total amount of deductible expenses?

What is the total amount of deductible expenses?

Definitions:

Iritis

An inflammation of the iris, the colored part of the eye, which can cause pain, redness, and potentially, loss of vision if not treated.

Astigmatism

A condition in which the cornea has an abnormal shape, which causes blurred images during near or distant vision.

Strabismus

A condition that results in a lack of parallel visual axes of the eyes; commonly called crossed eyes.

Presbyopia

A condition associated with aging in which the eye exhibits a progressively diminished ability to focus on near objects.

Q4: All of the following payments for medical

Q7: Phoebe's AGI for the current year is

Q8: In the most recent edition of Choose

Q12: Erin,Sarah,and Timmy are equal partners in EST

Q24: Reva is a single taxpayer with a

Q28: Which of the following statements regarding qualified

Q66: Payments from an annuity purchased from an

Q70: The wherewithal-to-pay concept provides that a tax

Q80: A taxpayer may deduct a loss resulting

Q91: Incremental expenses of an additional night's lodging