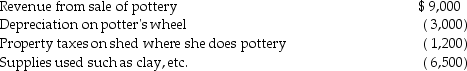

Lindsey Forbes,a detective who is single,operates a small pottery activity on a part-time basis.This year she reported the following income and expenses from this activity:  In addition,she had salary of $70,000 and itemized deductions,not including expenses listed above,of $6,800.

In addition,she had salary of $70,000 and itemized deductions,not including expenses listed above,of $6,800.

a.What is the amount of Lindsey's taxable income assuming the activity is classified as a hobby?

b.What is the amount of Lindsey's taxable income assuming the activity is classified as a trade or business?

Definitions:

Direct Labor

Labor costs that can be easily traced to individual units of product; essentially the wages paid to workers who directly manufacture goods.

Manufacturing Overhead

All indirect manufacturing costs, including but not limited to utilities, rent, and salaries of supervisors.

Direct Materials Cost

The expense incurred for raw materials that are directly traceable to the production of specific goods or services.

Raw Materials Inventory

The total cost of all the parts and materials that are held in stock by a company and are used in the production process.

Q14: Miranda is not a key employee of

Q22: In 2015,Carlos filed his 2014 state income

Q37: Blaine Greer lives alone.His support comes from

Q42: Teri pays the following interest expenses during

Q47: What is or are the standards that

Q77: According to the tax formula,individuals can deduct

Q99: The discharge of certain student loans is

Q108: Which of the following statements is incorrect

Q132: Darla sold an antique clock in 2015

Q137: Which statement is correct regarding SIMPLE retirement