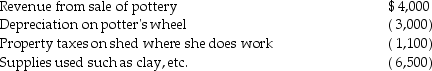

Margaret,a single taxpayer,operates a small pottery activity in her spare time.During the current year,she reported the following income and expenses from this activity which is classified as a hobby:  In addition,she had salary of $75,000 and itemized deductions,not including those listed above,of $2,200.

In addition,she had salary of $75,000 and itemized deductions,not including those listed above,of $2,200.

What is the amount of her taxable income?

Definitions:

Nonexcludability

A characteristic of certain goods or services where it is not feasible to exclude individuals from using the good or service, regardless of whether they have paid for it.

Negative Externality

A cost experienced by a third party not involved in the economic transaction, such as pollution affecting residents near a factory.

Spillover Cost

A cost incurred by someone who did not choose to incur that cost.

Allocative Efficiency

A state of the market where resources are allocated in a way that maximizes the net benefit to society.

Q8: Generally,deductions for adjusted gross income on an

Q13: Kendrick,who has a 33% marginal tax rate,had

Q24: An individual taxpayer has generated a net

Q42: Teri pays the following interest expenses during

Q57: For federal income tax purposes,income is allocated

Q66: Expenses paid with a credit card are

Q78: Unless the alternate valuation date is elected,the

Q80: Under the wash sale rule,if all of

Q84: Gabe Corporation,an accrual-basis taxpayer that uses the

Q86: If property received as a gift has