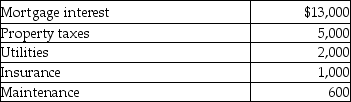

Ola owns a cottage at the beach.She and her family use the property for 30 days during the summer season and rent it to unrelated parties for 60 days.The rental receipts amount to $8,000.Total costs of operating the property are as follows:  In addition,potential depreciation expense is $9,000.

In addition,potential depreciation expense is $9,000.

a.Is the cottage subject to the vacation home rental limitations of IRC Sec.280A?

b.How much of expenses can Ola deduct?

Definitions:

Accident Rates

Measures or statistics indicating the frequency or occurrence of accidents within a particular environment or period.

New Procedures

Newly implemented methods or processes designed to improve efficiency, effectiveness, or both within an organization.

Job Hoppers

Individuals who frequently change jobs, often to seek better opportunities, higher salaries, or more fulfilling work.

Career Strategy

A plan that individuals design and implement to achieve their career goals, considering their strengths, weaknesses, and opportunities.

Q2: During the current year,Don's aunt Natalie gave

Q18: Assuming AGI below the threshold,a contributor may

Q21: Taxpayers may use the standard mileage rate

Q29: Joy purchased 200 shares of HiLo Mutual

Q47: Joycelyn gave a diamond necklace to her

Q56: Caleb's medical expenses before reimbursement for the

Q60: A married taxpayer may file as head

Q61: Sean and Martha are both over age

Q75: Tia is a 52-year-old an unmarried taxpayer

Q85: Lena owns a restaurant which was damaged