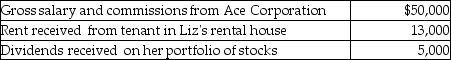

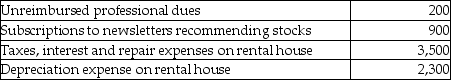

Liz,who is single,lives in a single family home and owns a second single family home that she rented for the entire year at a fair rental rate.Liz had the following items of income and expense during the current year. Income:  Expenses:

Expenses:  What is her adjusted gross income for the year?

What is her adjusted gross income for the year?

Definitions:

Reactive Intermediate

Transitory species that are formed during a chemical reaction and participate in further reaction steps until the final products are produced.

Oxidation

The process where a substance undergoes an increase in its oxidation state, often associated with the addition of oxygen or removal of hydrogen.

Reduction

A chemical process where a molecule, atom, or ion acquires electrons or undergoes a reduction in its oxidation state.

Oxidation

A chemical reaction that involves the loss of electrons by a molecule, atom, or ion.

Q2: All of the following items are excluded

Q4: A gift from an employee to his

Q20: During the year,Cathy received the following: •

Q37: Jack exchanged land with an adjusted basis

Q47: Gross income is limited to amounts received

Q53: The taxable portion of a gain from

Q62: Income from illegal activities is taxable.

Q97: Leslie,who is single,finished graduate school this year

Q105: Self-employed individuals receive a for AGI deduction

Q107: Taxpayers may elect to include net capital