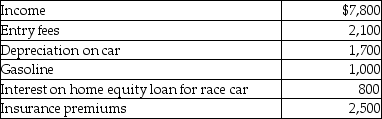

Kyle drives a race car in his spare time and on weekends.His records regarding this activity reflect the following information for the year.  What is the allowable deduction (before any AGI limitation) for depreciation assuming that this activity is not engaged in for profit and Kyle can itemize his deductions?

What is the allowable deduction (before any AGI limitation) for depreciation assuming that this activity is not engaged in for profit and Kyle can itemize his deductions?

Definitions:

Face-to-face Meetings

In-person gatherings where participants meet in the same location to engage in discussion or collaborative work.

Sensitive Issues

Topics or matters that require careful handling due to their potential to provoke emotional responses or controversy.

Workforce Motivation

The drive that stimulates an organization's employees to achieve personal and collective goals, often through incentives, job satisfaction, and rewards.

Situational Leadership Model

A leadership theory proposing that the most effective leaders adjust their style according to the maturity and competency level of their team members or followers.

Q16: A theft loss is deducted in the

Q50: An electrician completes a rewiring job and

Q75: Amy,a single individual and sole shareholder of

Q81: Marcia,who is single,finished graduate school this year

Q96: One of the requirements which must be

Q100: Deborah,who is single,is claimed as a dependent

Q102: All of the following items are deductions

Q105: Anita has decided to sell a parcel

Q115: What are some factors which indicate that

Q130: Interest credited to a bank savings account