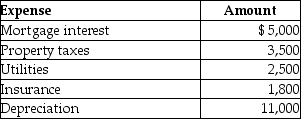

Mackensie owns a condominium in the Rocky Mountains.During the year,Mackensie uses the condo a total of 23 days.The condo is also rented to tourists for a total of 77 days and generates rental income of $10,900.Mackensie incurs the following expenses in the condo:  Using the court's method of allocating expenses,the amount of depreciation that Mackensie may take with respect to the rental property will be

Using the court's method of allocating expenses,the amount of depreciation that Mackensie may take with respect to the rental property will be

Definitions:

IOL

Stands for Intraocular Lens, an artificial lens implanted in the eye to treat conditions like cataracts.

Eyeballs

The globular organs in the skull through which vision is perceived; also known as the eyes.

Skull

The bony structure forming the head, protecting the brain and supporting the structures of the face.

Sensory Impulses

Electrical messages that are transmitted along sensory neurons, carrying information from sensory receptors to the central nervous system.

Q16: Jones,Inc.,a calendar-year taxpayer,is in the air conditioner

Q36: Explain why interest expense on investments is

Q44: Explain how tax planning may allow a

Q64: A taxpayer may avoid tax on income

Q76: Speak Corporation,a calendar year accrual basis taxpayer,sell

Q89: The portion of a taxpayer's wages that

Q102: The total worthlessness of a security generally

Q114: Galvin Corporation has owned all of the

Q117: Doug pays a county personal property tax

Q129: Distributions in excess of a corporation's current