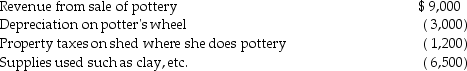

Lindsey Forbes,a detective who is single,operates a small pottery activity on a part-time basis.This year she reported the following income and expenses from this activity:  In addition,she had salary of $70,000 and itemized deductions,not including expenses listed above,of $6,800.

In addition,she had salary of $70,000 and itemized deductions,not including expenses listed above,of $6,800.

a.What is the amount of Lindsey's taxable income assuming the activity is classified as a hobby?

b.What is the amount of Lindsey's taxable income assuming the activity is classified as a trade or business?

Definitions:

Excretion

Elimination of metabolic wastes by an organism at exchange boundaries such as the plasma membrane of unicellular organisms and excretory tubules of multicellular animals.

Trichinella Worms

Parasitic roundworms that cause trichinosis, a disease that results from consuming undercooked meat containing cysts of the worm.

Skeletal Muscle

Striated, voluntary muscle tissue that comprises the majority of the muscles in the human body; also called striated muscle.

Pork

The culinary name for meat derived from domestic pigs, commonly consumed worldwide in various cuisines.

Q2: When are home-office expenses deductible?

Q18: Ben,age 67,and Karla,age 58,have two children who

Q18: Michelle purchased her home for $150,000,and subsequently

Q53: Carl filed his tax return,properly claiming the

Q78: Unless the alternate valuation date is elected,the

Q78: If a taxpayer makes a charitable contribution

Q84: If a taxpayer suffers a loss attributable

Q86: The tax law encourages certain forms of

Q112: Charlie owns activity B which was considered

Q129: Distributions in excess of a corporation's current