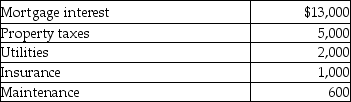

Ola owns a cottage at the beach.She and her family use the property for 30 days during the summer season and rent it to unrelated parties for 60 days.The rental receipts amount to $8,000.Total costs of operating the property are as follows:  In addition,potential depreciation expense is $9,000.

In addition,potential depreciation expense is $9,000.

a.Is the cottage subject to the vacation home rental limitations of IRC Sec.280A?

b.How much of expenses can Ola deduct?

Definitions:

Suicide

The act of intentionally causing one's own death, often as a result of despair, depression, or other mental health issues.

Depressive Episode

A period characterized by pervasive sadness, loss of interest in activities, and other symptoms such as changes in appetite, sleep disturbances, and feelings of worthlessness.

Onset

The beginning or start of something, often referring to the initial stage of a disease or condition.

Learned Helplessness

A state where an individual experiences feelings of being powerless, stemming from traumatic incidents or continuous lack of success.

Q6: Businesses can recognize a loss on abandoned

Q21: David has been diagnosed with cancer and

Q51: An accrual-basis taxpayer may elect to accrue

Q72: Joseph has AGI of $170,000 before considering

Q72: Why can business investigation expenditures be deducted

Q87: Which of the following statements is false?<br>A)A

Q87: For purposes of the application of the

Q99: Which of the following statements is false?<br>A)Under

Q104: Jordan paid $30,000 for equipment two years

Q120: Educational expenses incurred by a bookkeeper for