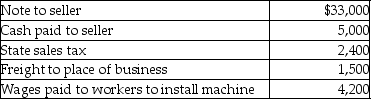

Dennis purchased a machine for use in his business.Mr.Dennis' costs in connection with this purchase were as follows:  What is the amount of Mr.Dennis' basis in the machine?

What is the amount of Mr.Dennis' basis in the machine?

Definitions:

Ethical Violations

Actions or behaviors that go against established moral codes or professional conduct standards.

Conduit

An entity that acts as an intermediary by channeling funds from lenders to borrowers or investors.

Financial Markets

Platforms or environments where buyers and sellers trade financial securities, commodities, and other fungible assets.

Intermediaries

Entities or people who act as a middleman or agent between two parties in a financial transaction or negotiation.

Q23: Under the accrual method of accounting,income is

Q25: Foreign real property taxes and foreign income

Q39: Paul and Hannah,who are married and file

Q69: Net long-term capital gains receive preferential tax

Q70: Dustin purchased 50 shares of Short Corporation

Q72: Due to stress on the job,taxpayer Charlie

Q83: A taxpayer suffers a casualty loss on

Q100: If stock sold or exchanged is not

Q116: Losses are generally deductible if incurred in

Q134: Losses on the sale of property between