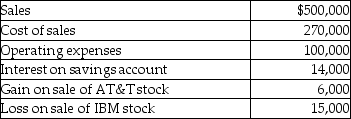

In the current year,ABC Corporation had the following items of income,expense,gains,and losses:  What is taxable income for the year?

What is taxable income for the year?

Definitions:

Passive Strategy

An investment strategy involving minimal buying and selling actions, typically focused on long-term investment in index funds or Exchange-Traded Funds (ETFs).

Steps

A sequence of actions or procedures taken in order to achieve a particular end.

Jensen Portfolio Evaluation Measure

The Jensen Portfolio Evaluation Measure is a performance metric that assesses the return of an investment portfolio while adjusting for risk, comparing it to the expected return of the market with a given risk level.

CAPM

The Capital Asset Pricing Model is a theoretical framework that explains how the expected return on assets, especially stocks, is related to their systematic risk.

Q42: In March of the current year,Marcus began

Q53: Carl filed his tax return,properly claiming the

Q57: Investment interest includes interest expense incurred to

Q66: Nicole has a weekend home on Pecan

Q84: Michelle,age 20,is a full-time college student with

Q91: The amount of cash fringe benefits received

Q98: All of the following statements are true

Q111: The Super Bowl is played in Tasha's

Q113: Paige is starting Paige's Poodle Parlor and

Q142: Julia provides more than 50 percent of