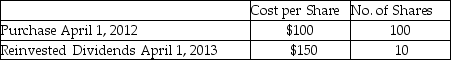

Rachel holds 110 shares of Argon Mutual Fund.She is planning to sell 90 shares.Her record of the share purchases is noted below.What could be her basis for the 90 shares to be sold for purposes of determining gain?

Definitions:

Profit Maximization

The procedure through which a business identifies the pricing and production volume that yields the highest earnings.

Market Price

The price at which a good or service is offered in the marketplace.

Profit Maximization

A rephrased definition: The strategy or aim of a firm to achieve the highest profit possible, usually by adjusting outputs, prices, or production costs.

Market Price

The current price at which an asset or service can be bought or sold in the open market.

Q17: Kelsey is a cash-basis,calendar-year taxpayer.Her salary is

Q32: Will exchanges a building with a basis

Q38: Jeffrey,a T.V.news anchor,is concerned about the wrinkles

Q46: A taxpayer reports capital gains and losses

Q51: When two or more people qualify to

Q56: Lisa loans her friend,Grace,$10,000 to finance a

Q59: Which one of the following is a

Q83: Amounts withdrawn from Qualified Tuition Plans are

Q114: Jarrett owns a mountain chalet that he

Q119: Natasha,age 58,purchases an annuity for $40,000.Natasha will