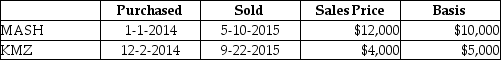

Nate sold two securities in 2015:  Nate has a 25% marginal tax rate.What is the additional tax resulting from the above sales?

Nate has a 25% marginal tax rate.What is the additional tax resulting from the above sales?

Definitions:

Annual Dividend

The complete sum of dividends a shareholder gets from a corporation over the course of a single fiscal year.

Dividend Increase

An action by a company to increase the amount of money paid out to shareholders per share, typically signaling financial health.

Market Rate

The current market rate for interest on investments or loans available in the marketplace.

Annual Dividend

The annual dividend income a shareholder is awarded from a company.

Q12: Stacy,who is married and sole shareholder of

Q25: Emma is the sole shareholder in Pacific

Q51: Individual taxpayers can offset portfolio income with

Q53: Ted pays $2,100 interest on his automobile

Q56: Accelerated death benefits received by a terminally

Q62: Annisa,who is 28 and single,has adjusted gross

Q91: In the current year,Marcus reports the following

Q94: Sacha,a dentist,has significant investment assets.She holds corporate

Q118: Purchase of a bond at a significant

Q133: Super Development Company purchased land in the