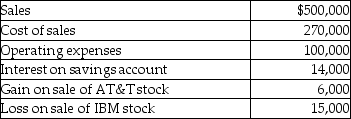

In the current year,ABC Corporation had the following items of income,expense,gains,and losses:  What is taxable income for the year?

What is taxable income for the year?

Definitions:

Corporate Vertical Marketing System

A tightly integrated supply chain structure where a single company owns or controls each step of the production and distribution process.

21st Century Fox

A former American multinational mass media corporation involved in film and television production, known for its significant influence in the entertainment industry.

Integrated Marketing System

A cohesive marketing strategy that ensures all forms of communications and messages are linked together and support the core brand message.

Retailer-sponsored Cooperative

A group of independent retailers that band together to purchase in bulk and enhance their marketing efforts, sharing costs and benefits.

Q17: Katie,a self-employed CPA,purchased an accident & disability

Q32: In community property states,income from separate property

Q39: In the current year,Andrew received a gift

Q57: Medical expenses in excess of 10% of

Q69: On September 1,of the current year,Samuel,a cash-basis

Q69: In computing the alternative minimum taxable income,no

Q86: On December 1,Robert,a cash method taxpayer,borrows $10,000

Q96: Faye is a marketing manager for Healthy

Q119: In general,the deductibility of interest depends on

Q133: Chen had the following capital asset transactions