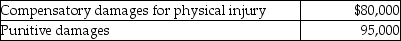

Derrick was in an automobile accident while he was going to work.The doctor advised him to stay home for eight months due to his physical injuries.The resulting lawsuit was settled and Derrick received the following amounts:  How much of the settlement must Derrick include in ordinary income on his tax return?

How much of the settlement must Derrick include in ordinary income on his tax return?

Definitions:

Fireproofing

The process of making materials or structures more resistant to fire through the application of fire-retardant materials, techniques, or treatments.

Textile Industries

are sectors of the economy dedicated to the production of fibers, yarns, fabrics, and the manufacturing of clothing and other textile products.

Automotive Occupations

Professions involved in the design, development, manufacturing, and maintenance of vehicles.

Chronic Obstructive Pulmonary Disease

A group of lung conditions, including emphysema and chronic bronchitis, that block airflow and make breathing difficult.

Q7: Bad debt losses from nonbusiness debts are

Q7: The standard deduction may not be claimed

Q14: Sari is single and has taxable income

Q37: A taxpayer has low AGI this year,but

Q48: Tyler has rented a house from Camarah

Q54: If estimated tax payments equal or exceed

Q60: As a result of a divorce,Michael pays

Q94: Sacha,a dentist,has significant investment assets.She holds corporate

Q105: Anita has decided to sell a parcel

Q121: A taxpayer acquired an office building to