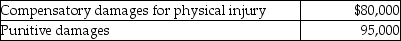

Derrick was in an automobile accident while he was going to work.The doctor advised him to stay home for eight months due to his physical injuries.The resulting lawsuit was settled and Derrick received the following amounts:  How much of the settlement must Derrick include in ordinary income on his tax return?

How much of the settlement must Derrick include in ordinary income on his tax return?

Definitions:

Coping Skills

Techniques or strategies that individuals use to manage stress, challenges, or difficult emotions.

Strengths-Based Questions

Inquiry methods used in coaching or therapy that focus on a person's strengths and resources rather than on deficits or problems.

Personal Flaw

A characteristic or trait within an individual that is perceived as a weakness or imperfection.

Support

Assistance or encouragement given to someone, often during difficult times, to help them cope, manage, or succeed.

Q14: ChocoHealth Inc.is developing new chocolate products providing

Q44: Ronna is a professional golfer.In order to

Q50: On January 31 of this year,Jennifer pays

Q66: Expenses paid with a credit card are

Q69: Norah,who gives music lessons,is a calendar year

Q71: A net Sec.1231 gain is treated as

Q105: This summer,Rick's home (which has a basis

Q108: Payments received from a workers' compensation plan

Q111: When are points paid on a loan

Q112: Upon the sale of property,a portion of