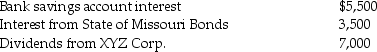

Kevin is a single person who earns $70,000 in salary for 2015 and has other income from a variety of investments,as follows:  Kevin received tax refunds when he filed his 2014 tax returns in April of 2015.His federal refund was $600 and his state refund was $300.Kevin claimed the $300 state tax overpayment as an itemized deduction on his 2014 return.Due to changes in circumstances,Kevin is not itemizing deductions on his 2015 return.

Kevin received tax refunds when he filed his 2014 tax returns in April of 2015.His federal refund was $600 and his state refund was $300.Kevin claimed the $300 state tax overpayment as an itemized deduction on his 2014 return.Due to changes in circumstances,Kevin is not itemizing deductions on his 2015 return.

Compute Kevin's taxable income for 2015.

Definitions:

Q14: Blair,whose tax rate is 28%,sells one tract

Q74: Cassie owns equipment ($45,000 basis and $30,000

Q79: Donald sells stock with an adjusted basis

Q80: Billy,age 10,found an old baseball glove while

Q82: If property is involuntarily converted into similar

Q108: According to Sec.121,individuals who sell or exchange

Q110: Rick sells stock of Ty Corporation,which has

Q120: Joan earns $110,000 in her job as

Q133: Super Development Company purchased land in the

Q137: Hoyt rented office space two years ago