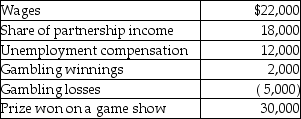

Lori had the following income and losses during the current year:  What is Lori's adjusted gross income?

What is Lori's adjusted gross income?

Definitions:

T Account

A T account is a visual aid in accounting used to depict the debits and credits of a particular ledger account, facilitating the understanding and analysis of transactions.

Balance Entered

A term that is not typically used in standard financial or accounting lexicon; it could imply recording or entering a balance into financial records. NO.

Trial Balance Preparation

The process of creating a trial balance, which is a bookkeeping worksheet listing the balance of all ledgers for checking the mathematical correctness of the books.

Account Balance

The amount of money in a financial repository at any given moment, which can represent credit or debit balances.

Q1: Gwen's marginal tax bracket is 25%.Gwen pays

Q24: Jeffery and Cassie,who are married with modified

Q25: Emma is the sole shareholder in Pacific

Q35: "Working condition fringe benefits," such as memberships

Q39: Daniella exchanges business equipment with a $100,000

Q61: Amy's employer provides her with several fringe

Q63: Coretta sold the following securities during 2015:

Q67: Jamal,age 52,is a human resources manager for

Q87: The maximum amount of the American Opportunity

Q92: An expense is considered necessary if it