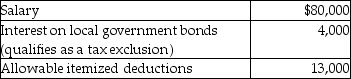

A single taxpayer provided the following information for 2015:  What is taxable income?

What is taxable income?

Definitions:

Share Holdings

Ownership of a portion of a company through possession of its stock.

Lowest Terms

A fraction simplified to its most basic form, where the numerator and denominator are the smallest possible integers.

Ratio

A numerical ratio representing how often one number can be divided by another, showing either how many times one is included in the other or vice versa.

Partnership Interest

Ownership share or participation in a partnership that usually entitles the holder to a proportion of the partnership's profits and assets.

Q14: Sari is single and has taxable income

Q27: Which of the following is not excluded

Q28: Alimony received is taxable to the recipient

Q31: Aaron found a prototype of a new

Q38: A taxpayer had the following income and

Q39: In the current year,Andrew received a gift

Q55: Discuss why Congress passed the innocent spouse

Q105: Frank and Marion,husband and wife,file separate returns.Frank

Q127: For purposes of the child and dependent

Q127: Juanita's mother lives with her.Juanita purchased clothing